Financing statistics

How much capital is needed to start a small business? The amount of funding needed to launch a small business can vary widely according to an entrepreneur’s business plan. For a home-based business, $5000 may be enough to get off the ground, while opening a restaurant in a centrally located area can cost up to $500,000.

The Ewing Marion Kauffman Foundation estimates that $30,000 is the average cost of starting a small business.

Micro-businesses will need at least $2000 to start, according to the SBA. However, lots of home-based franchises will cost between $2000-$5000.

According to independent surveys, it is estimated that online-only business owners spend an average of $35,000 during the first year of operation. However, some entrepreneurs will spend more depending on the type of business they are running.

What percentage of small businesses are self-financed? According to statistics, 78 percent of small business owners use their own funds to launch their businesses. However, lots of small businesses will eventually need funding at some point. The total amount of outstanding loans for small businesses reached $645 billion in 2019, and this number is so high because the average SBA loan is approximately $417,316.

Businesses that need large amounts of financing opt for business loans; however, another common method for businesses to pay their expenses is business credit cards. However, the interest rates on credit cards tend to be much higher than business loans, so they’re not the best option for long-term financing.

However, in terms of accessibility, credit cards are definitely more accessible than business loans, and they also offer perks and rewards that business loans do not include.

What percentage of small businesses are financed by other means? 16% of businesses are funded by bank loans, while loans from family and friends account for 2-6% of initial small business funding.

The following business lending statistics will help you understand the small business trends:

Approval rates from certain institutions are much lower than the rates of SBA loans overall, which are as follows:

The SBA 7 (a) loan rates are 9.25% to 11.75%.

How long does it take to receive financing after your loan’s been approved? Funding and loan approval by the SBA could take as long as 60 to 90 days.

However, it’s important to note that money is not loaned directly to small business owners by the SBA. Instead, they guarantee up to 85% of the loan amount, depending on the amount as well as the loan program.

The advantage is that it reduces the risk of loaning money to applicants and also encourages SBA-approved lenders to work hand-in-hand with small-business applicants who may not otherwise be approved.

There are several SBA loan programs, including SBA 7 (a) loans, SBA express loans, Certified Development Company (CDC)/504 loans, and SBA microloans.

How many small businesses use accountants? As of 2021, 62% of small businesses have in-house accountants. However, 30% of small business owners choose to work with external accountants. 8.64% of business owners do their own bookkeeping, while 64.4% make use of accounting software.

What’s the most common type of legal structure for a small business?The most common type of business structure for small businesses is sole proprietorships. This is because they are the easiest business structure to form with the least amount of government regulation. Partnerships are also relatively easy to form, and limited liability companies seem to be the next most common option for small businesses in the US.

Nearly half (47.3%) of small employer businesses (businesses with 1-100 employers) are S-corporations, which is the most common type of organization for this type of business.

A whopping 86.4% of non-employer businesses are sole proprietorships, while just 14.4% of small employer businesses are sole proprietorships.

What is the average tax rate that a small business pays? The amount of tax a small business pays depends on how much the business is making and also whether it’s a pass-through entity or corporation. Pass-through business entities pay taxes at the owner’s income-based marginal tax rate, which ranges from 10 to 37%. Corporations, on the other hand, pay a flat tax of 21% on business profits.

How much capital is needed to start a small business? The amount of funding needed to launch a small business can vary widely according to an entrepreneur’s business plan. For a home-based business, $5000 may be enough to get off the ground, while opening a restaurant in a centrally located area can cost up to $500,000.

The Ewing Marion Kauffman Foundation estimates that $30,000 is the average cost of starting a small business.

Micro-businesses will need at least $2000 to start, according to the SBA. However, lots of home-based franchises will cost between $2000-$5000.

According to independent surveys, it is estimated that online-only business owners spend an average of $35,000 during the first year of operation. However, some entrepreneurs will spend more depending on the type of business they are running.

What percentage of small businesses are self-financed? According to statistics, 78 percent of small business owners use their own funds to launch their businesses. However, lots of small businesses will eventually need funding at some point. The total amount of outstanding loans for small businesses reached $645 billion in 2019, and this number is so high because the average SBA loan is approximately $417,316.

Businesses that need large amounts of financing opt for business loans; however, another common method for businesses to pay their expenses is business credit cards. However, the interest rates on credit cards tend to be much higher than business loans, so they’re not the best option for long-term financing.

However, in terms of accessibility, credit cards are definitely more accessible than business loans, and they also offer perks and rewards that business loans do not include.

What percentage of small businesses are financed by other means? 16% of businesses are funded by bank loans, while loans from family and friends account for 2-6% of initial small business funding.

The following business lending statistics will help you understand the small business trends:

- The SBA distributed over 14 million loans worth $764 billion to small businesses in 2020.

- 33% of business people experience challenges or failure due to a lack of capital

- The average SBA loan is $417,316, and the maximum loan amount is $5 million.

- Large banks are responsible for 89.5% of smaller loans given to small businesses.

Approval rates from certain institutions are much lower than the rates of SBA loans overall, which are as follows:

- SBA loans have a 25% approval rate at large banks

- SBA loans have a 49% approval rate at small banks

The SBA 7 (a) loan rates are 9.25% to 11.75%.

How long does it take to receive financing after your loan’s been approved? Funding and loan approval by the SBA could take as long as 60 to 90 days.

However, it’s important to note that money is not loaned directly to small business owners by the SBA. Instead, they guarantee up to 85% of the loan amount, depending on the amount as well as the loan program.

The advantage is that it reduces the risk of loaning money to applicants and also encourages SBA-approved lenders to work hand-in-hand with small-business applicants who may not otherwise be approved.

There are several SBA loan programs, including SBA 7 (a) loans, SBA express loans, Certified Development Company (CDC)/504 loans, and SBA microloans.

How many small businesses use accountants? As of 2021, 62% of small businesses have in-house accountants. However, 30% of small business owners choose to work with external accountants. 8.64% of business owners do their own bookkeeping, while 64.4% make use of accounting software.

What’s the most common type of legal structure for a small business?The most common type of business structure for small businesses is sole proprietorships. This is because they are the easiest business structure to form with the least amount of government regulation. Partnerships are also relatively easy to form, and limited liability companies seem to be the next most common option for small businesses in the US.

Nearly half (47.3%) of small employer businesses (businesses with 1-100 employers) are S-corporations, which is the most common type of organization for this type of business.

A whopping 86.4% of non-employer businesses are sole proprietorships, while just 14.4% of small employer businesses are sole proprietorships.

What is the average tax rate that a small business pays? The amount of tax a small business pays depends on how much the business is making and also whether it’s a pass-through entity or corporation. Pass-through business entities pay taxes at the owner’s income-based marginal tax rate, which ranges from 10 to 37%. Corporations, on the other hand, pay a flat tax of 21% on business profits.

Small Business Financing

According to the SBA’s Office of Advocacy:

• Financing startups: “Startups make heavy use of personal equity and traditional debt, with over half using their own personal savings. Census Bureau data show that employers made greater use of financing than did nonemployers, but also continue to rely on personal savings. Roughly 30% of new nonemployer firms and 7% of employer firms used no startup capital.”

• Business expansion: “Existing businesses use similar financing vehicles as startups to finance expansion. Personal savings are the most common source of expansion finance, followed by reinvestment of business profits.”

New Business Applications:

The U.S. Census Bureau publishes data on new business applications – that is, “business applications for tax IDs as indicated by applications for an Employer Identification Number (EIN) through filings of IRS Form SS-4” – dating back to July 2004. These numbers are not actual business formations, but instead, a measure of individuals filing for tax ID numbers. From this data, projections regarding actual future business formations are made.

With the onset of the pandemic in 2020, one of the most encouraging and surprising results was the dramatic leap up in terms of business applications. This is encouraging for future growth in entrepreneurship, which is vital to economic recovery and growth.

Total Business Applications Reached Record Levels:

As noted in the following two charts, total business applications and high-propensity business applications (that is, businesses most likely to have payrolls) both registered record levels in 2021, with total business applications registering 5.4 million and high-propensity applications coming in at 1.8 million.

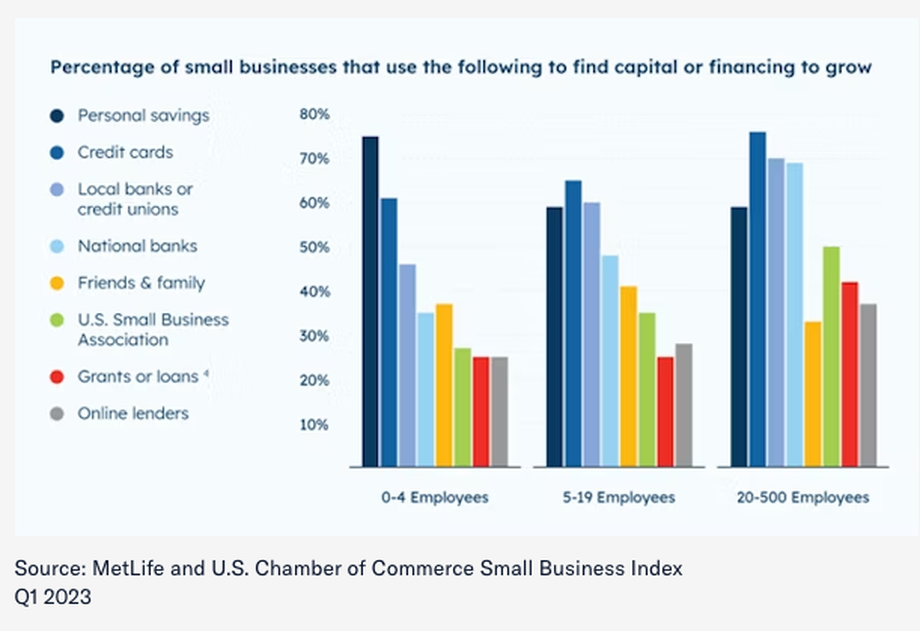

Access to capital declines

Over the long term, small businesses’ perceived access to capital to fund and grow their business has declined.

According to the Q1 2023 Small Business Index, almost half (49%) of small business owners said their current access to capital or loans is good. This is slightly lower than those who rated their access to capital as good in Q2 2022 (54%) and significantly lower than in Q2 2017 (67%).

Inflation bites:

Amid historically high inflation, many small businesses are struggling to keep up with rising prices. Ove the past year, inflation has been the top concern of small businesses by far, according to the MetLife and U.S. Chamber of Commerce Small Business Index. In the latest survey, over half of small businesses said inflation is the top challenge facing the small business community.

• Financing startups: “Startups make heavy use of personal equity and traditional debt, with over half using their own personal savings. Census Bureau data show that employers made greater use of financing than did nonemployers, but also continue to rely on personal savings. Roughly 30% of new nonemployer firms and 7% of employer firms used no startup capital.”

• Business expansion: “Existing businesses use similar financing vehicles as startups to finance expansion. Personal savings are the most common source of expansion finance, followed by reinvestment of business profits.”

New Business Applications:

The U.S. Census Bureau publishes data on new business applications – that is, “business applications for tax IDs as indicated by applications for an Employer Identification Number (EIN) through filings of IRS Form SS-4” – dating back to July 2004. These numbers are not actual business formations, but instead, a measure of individuals filing for tax ID numbers. From this data, projections regarding actual future business formations are made.

With the onset of the pandemic in 2020, one of the most encouraging and surprising results was the dramatic leap up in terms of business applications. This is encouraging for future growth in entrepreneurship, which is vital to economic recovery and growth.

Total Business Applications Reached Record Levels:

As noted in the following two charts, total business applications and high-propensity business applications (that is, businesses most likely to have payrolls) both registered record levels in 2021, with total business applications registering 5.4 million and high-propensity applications coming in at 1.8 million.

Access to capital declines

Over the long term, small businesses’ perceived access to capital to fund and grow their business has declined.

According to the Q1 2023 Small Business Index, almost half (49%) of small business owners said their current access to capital or loans is good. This is slightly lower than those who rated their access to capital as good in Q2 2022 (54%) and significantly lower than in Q2 2017 (67%).

Inflation bites:

Amid historically high inflation, many small businesses are struggling to keep up with rising prices. Ove the past year, inflation has been the top concern of small businesses by far, according to the MetLife and U.S. Chamber of Commerce Small Business Index. In the latest survey, over half of small businesses said inflation is the top challenge facing the small business community.

|

About Us: Our Story_Contact Us

Ohana Specials Technology Park Office Landing Cannabis Island Living & Style Something for You Food Court Healthy You (Coming Soon) Travel (Coming Soon) |

©2024 ohanacity.com